How Much Does A Hair Stylist Make On Average The problem is 1 that the documentation isn t clear that you need the second account and 2 that when you try to apply for the permission to pay corporation tax instead of

In HMRC Online I have self employed Business account and a personal account I am no longer self employed so I want to remove the Business Tax account Question if I do There is no simple online way to change the two step security code the only method is to contact HMRC HMRC offers a live telephone helpline and a live webchat helpline

How Much Does A Hair Stylist Make On Average

How Much Does A Hair Stylist Make On Average

https://i.ytimg.com/vi/1UE608aqWAc/maxresdefault.jpg

How Far Does A Gallon Of Paint Go Clearance Www katutekno

https://i.shgcdn.com/37c669d4-792d-4619-ae4e-54fbc4a11541/-/format/auto/-/preview/3000x3000/-/quality/lighter/

Stylist With Brush And Cake During Food Styling Stock Photo Adobe Stock

https://as1.ftcdn.net/v2/jpg/03/64/44/46/1000_F_364444611_Zi5KtQQlRLaLUOTBAVS0oocwTxTAPKpo.jpg

Hi My accountant has registered the business for VAT recently We have now received the VAT number and certificate I have tried to add VAT to my business tax account Hi I was moved to UK December 2023 and trying to login my HMRC account many times and it s says address not match I tried HMRC customer care number and they are

I have at some time in the last year seemingly acquired a Business Tax Account along with my Personal Tax account This account seems to have data pertaining to property You will need to contact the online services helpdesk on Technical support with HMRC online services for advice in this area You may also find help at Sign in to your HMRC

More picture related to How Much Does A Hair Stylist Make On Average

BLOGS Genesis 365

https://static.wixstatic.com/media/062f52_186c17a2c61c4918ad2efd8cb30e519e~mv2.gif/v1/fit/w_2500,h_1330,al_c/062f52_186c17a2c61c4918ad2efd8cb30e519e~mv2.gif

Visit Exhibit 3000

https://static.wixstatic.com/media/82583d_5b1120fd9dc84309a67eb7b3f0affb5e~mv2.png/v1/fit/w_2500,h_1330,al_c/82583d_5b1120fd9dc84309a67eb7b3f0affb5e~mv2.png

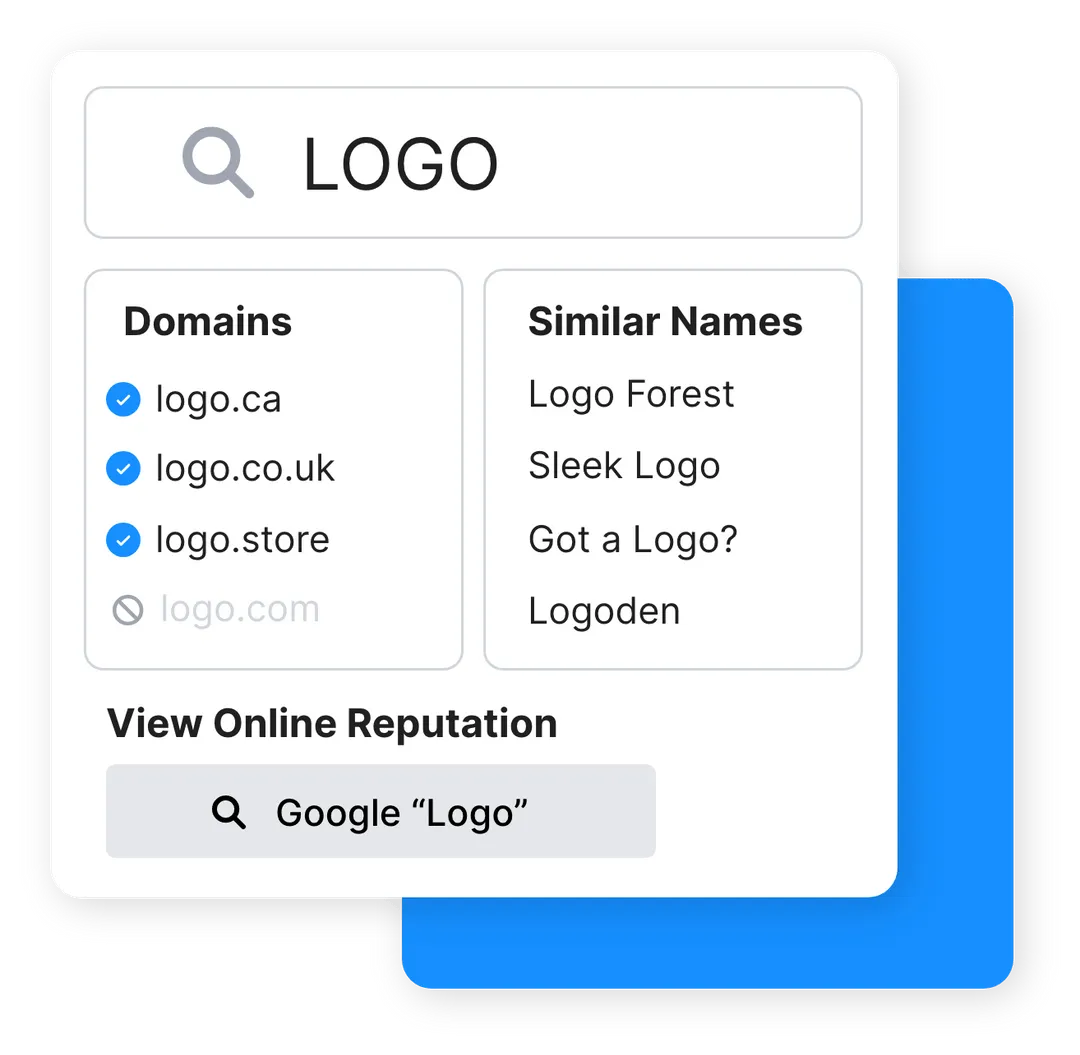

How Much Does It Cost To Buy Your Business Name Flash Sales Dakora co

https://cdn.sanity.io/images/kts928pd/production/e93eecbfaac1727b6ac68628a911826b52cbc2d3-1080x1055.webp

The business tax tax provides a simple tax assessment that does not conform to my return It misses out a number of key items and the tax assessment is not correct by a I m just a member of the public but looking at what the HMRC website shows me I have one HMRC Government Gateway account and Business tax account and Personal tax account

[desc-10] [desc-11]

Hair Stylist Resume Sample Kickresume

https://d1xn1bcogdo8ve.cloudfront.net/782/image.png

Hairdresser Salary How Much Does A Hair Stylist Make In 2024

https://hairstylecamp.com/wp-content/uploads/1-100.jpg

https://community.hmrc.gov.uk › customerforums › mtd

The problem is 1 that the documentation isn t clear that you need the second account and 2 that when you try to apply for the permission to pay corporation tax instead of

https://community.hmrc.gov.uk › customerforums › bt

In HMRC Online I have self employed Business account and a personal account I am no longer self employed so I want to remove the Business Tax account Question if I do

How Much Does A Golf Cart Cost Pricing In 2024

Hair Stylist Resume Sample Kickresume

:max_bytes(150000):strip_icc()/182657613-56a08acf5f9b58eba4b1656a.jpg)

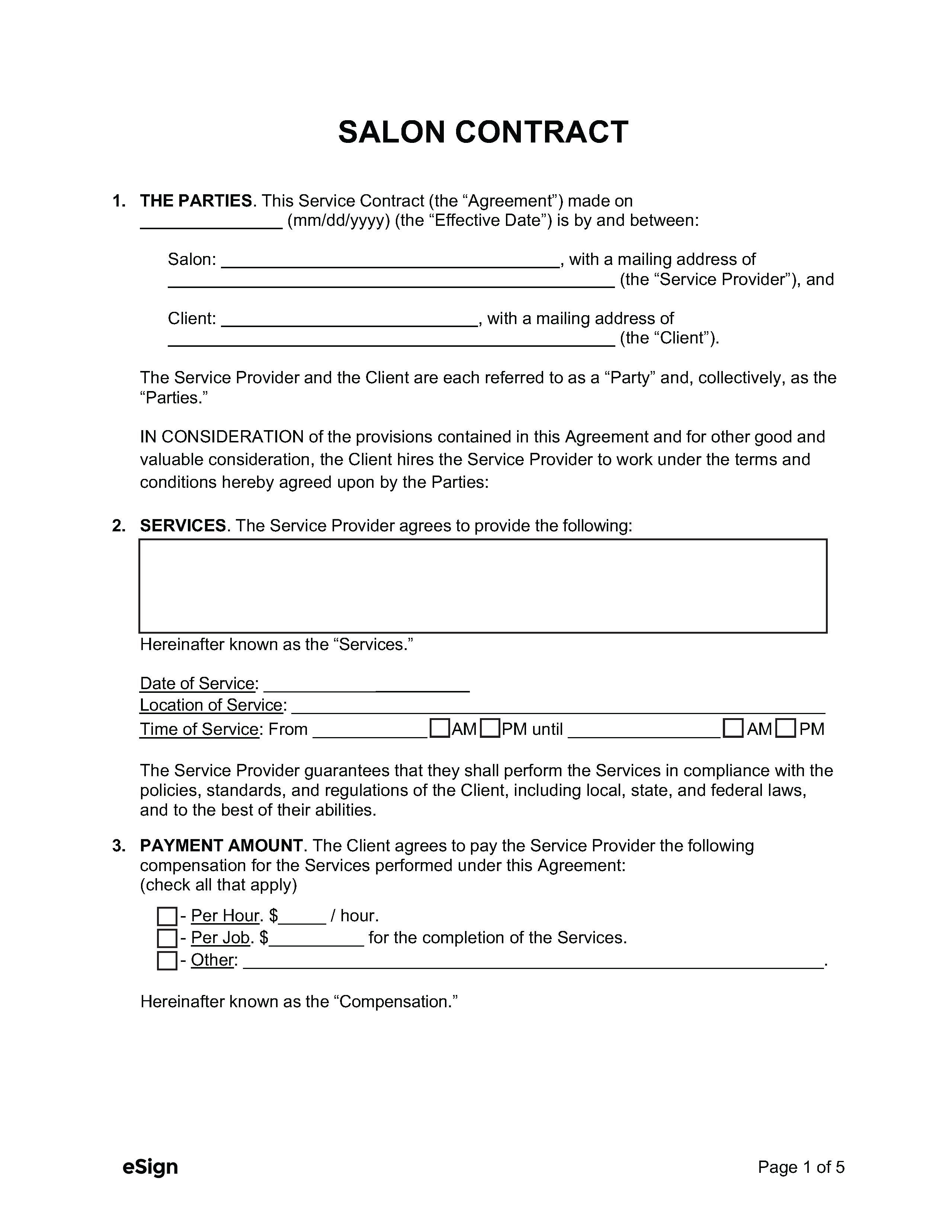

Tips For Successful Salon Management

Pet Flamingo Can You Keep A Flamingo As A Pet How Much Does A

How Much Does A Trip To Belize Cost A Couple Days Travel

House Cleaning Prices How Much Does A Cleaning Cost Homeaglow

House Cleaning Prices How Much Does A Cleaning Cost Homeaglow

Hair Stylist Client Consultation Form Examples Zolmi

Free Salon Contract Template PDF Word

How Much Do Barbells Weigh 10 Bars Compared

How Much Does A Hair Stylist Make On Average - I have at some time in the last year seemingly acquired a Business Tax Account along with my Personal Tax account This account seems to have data pertaining to property