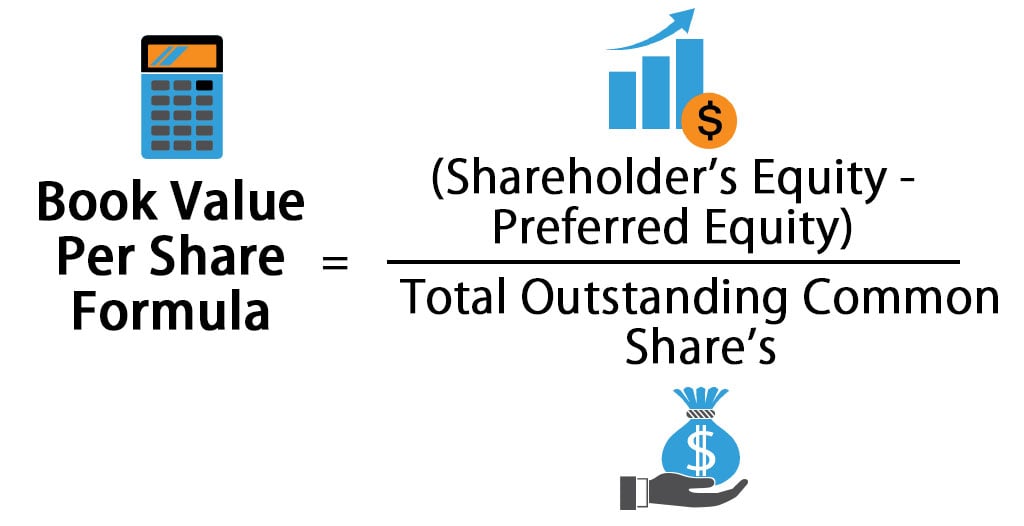

The Book Value Of Ordinary Shares Is The Same As The book value per share formula is used to calculate the per share value of a company based on its equity available to common shareholders The term book value is a company s assets

For example if a company has total assets worth 500 crore total liabilities of 200 crore and one crore outstanding shares the book value per share would be What is Book Value Per Share The Book Value Per Share BVPS is the per share value of equity on an accrual accounting basis that belongs to the common

The Book Value Of Ordinary Shares Is The Same As

The Book Value Of Ordinary Shares Is The Same As

https://i.ytimg.com/vi/O6XUeWUi61c/maxresdefault.jpg

B Ltd Issued 20 000 Equity Shares Of 100 Each At A Premium Of 20 Per

https://hi-static.z-dn.net/files/d44/93c4bd264ddba41773473de0de2ca898.jpg

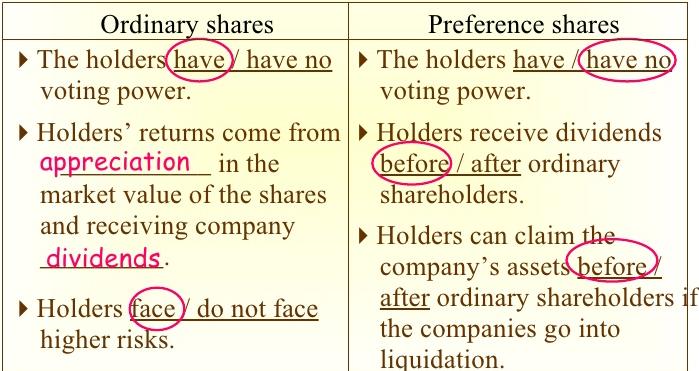

Ordinary Shares Ordinary Shares Vs Preference Shares

https://cdn.educba.com/academy/wp-content/uploads/2020/09/Ordinary-Shares.jpg

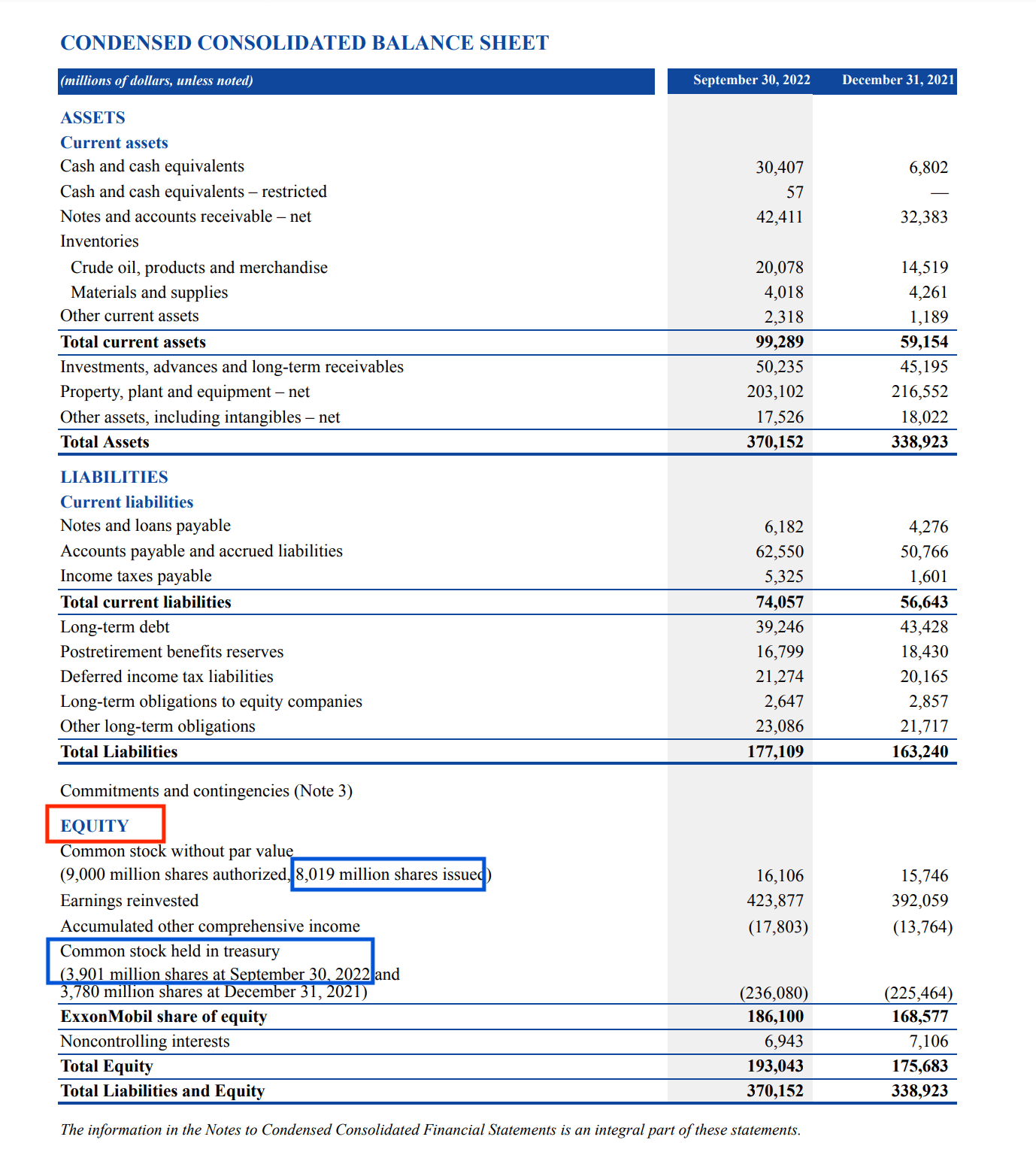

Book Value The full value of shares does not represent the true worth of share of acompany Book value can be calculated as Reserves and accumulated profits are added to share capital Book Value per Share is the amount that would be paid on each preference share and ordinary share assuming the entity is liquidated and the amount available to shareholders is exactly the same amount reported as shareholders equity

Face value A company may divide its share capital into shares of Rs 10 or 100 Book Value The value calculated based upon the book values of the company Total No of Shares Book Value Per Share BVPS is a crucial financial metric that indicates the per share value of a company s equity available to common shareholders It helps investors determine if a

More picture related to The Book Value Of Ordinary Shares Is The Same As

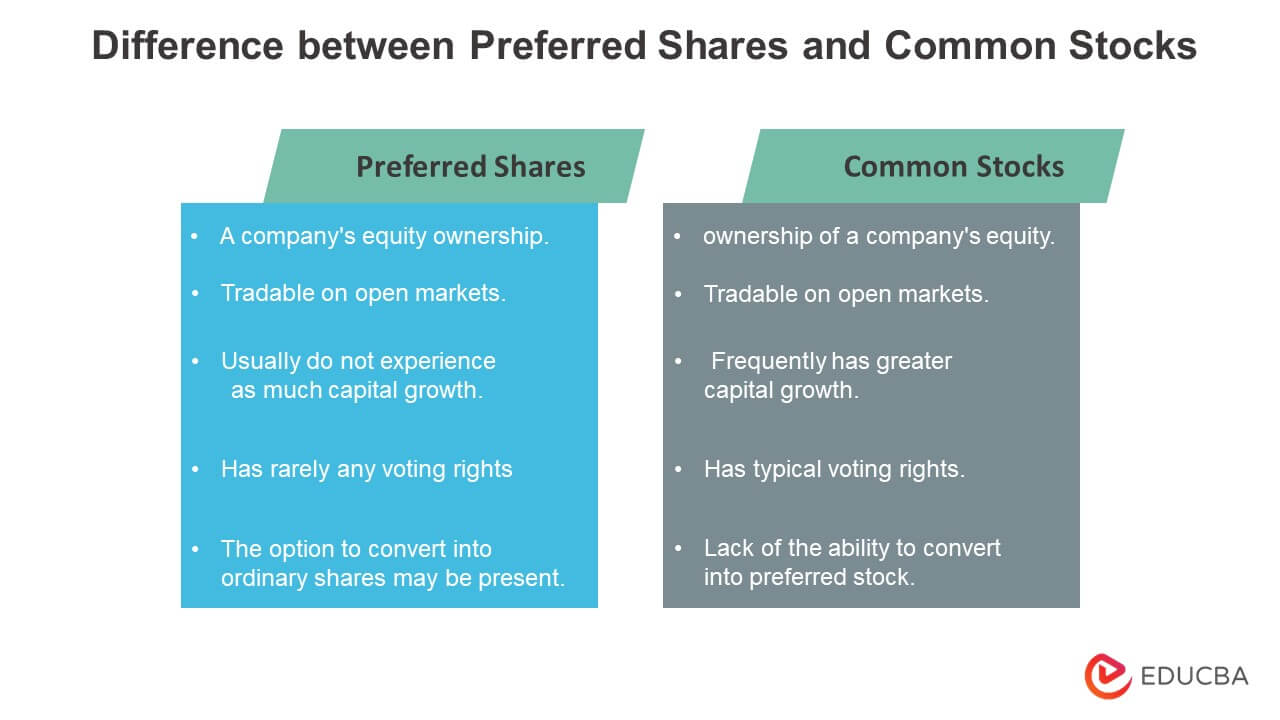

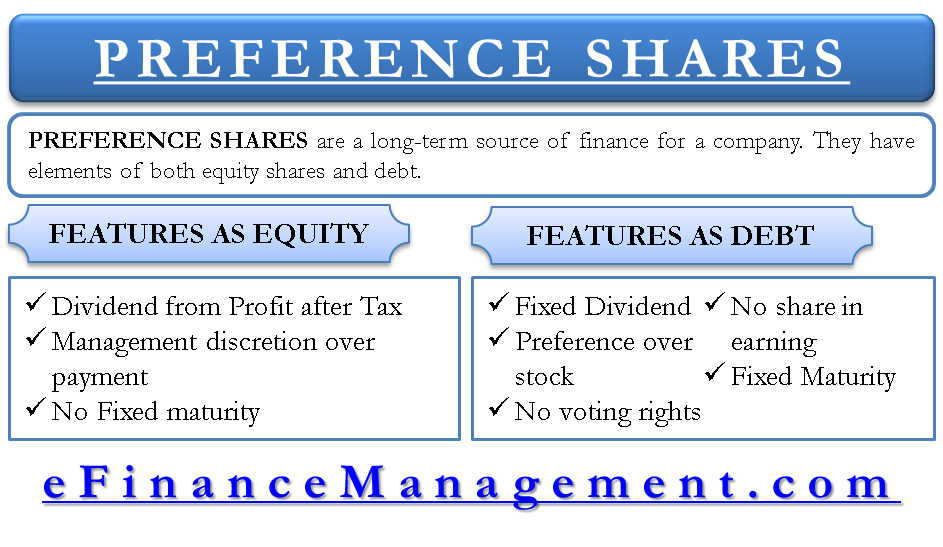

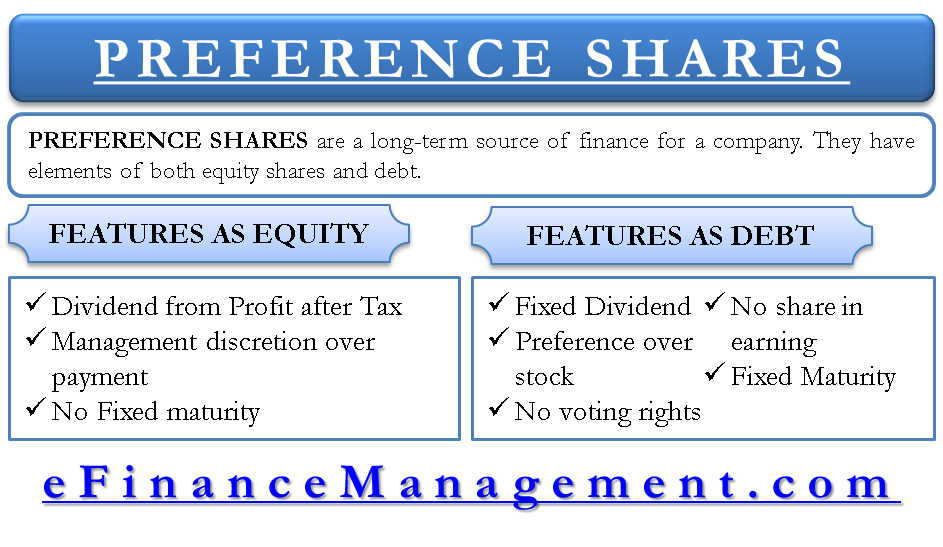

Preferred Shares Features Types Advantages And Disadvantages

https://cdn.educba.com/academy/wp-content/uploads/2020/10/Difference-between-Preferred-Shares-and-Common-Stocks.jpg

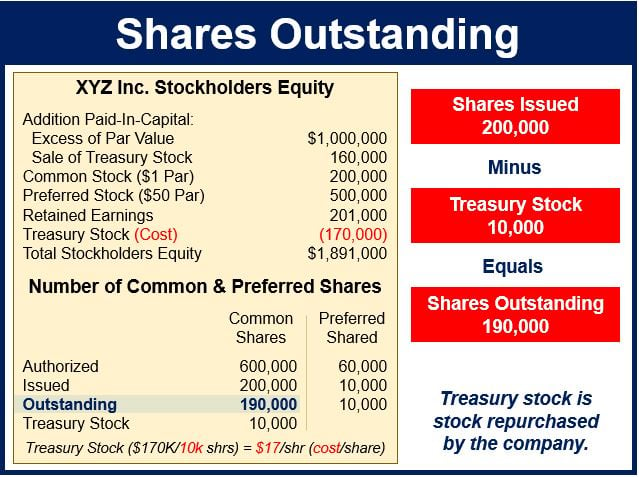

Shares Outstanding Types How To Find And Float Stock Analysis

https://stockanalysis.com/api/assets/cms/05ae9082-c5b9-46b0-9741-7e97dd7e57a9.jpg

Differences Between Ordinary Share And Preference Share AbramafeGood

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/07/11045324/Common-Shares-versus-Preferred-Shares-Comparison.jpg

Understanding the book value per share calculation formula is crucial for those looking to find a company s real worth It shows if a company s management is good at making The Book Value Per Share formula calculates the value that each outstanding common share holds by dividing the total book value by the number of common shares The book to market

What is the Book Value per Share Book value per share BVPS is a fundamental financial metric that represents a company s net asset value on a per share Book Value per Share is the amount that would be paid on each share assuming the entity is liquidated and the amount available to the shareholders is exactly the same amount reported

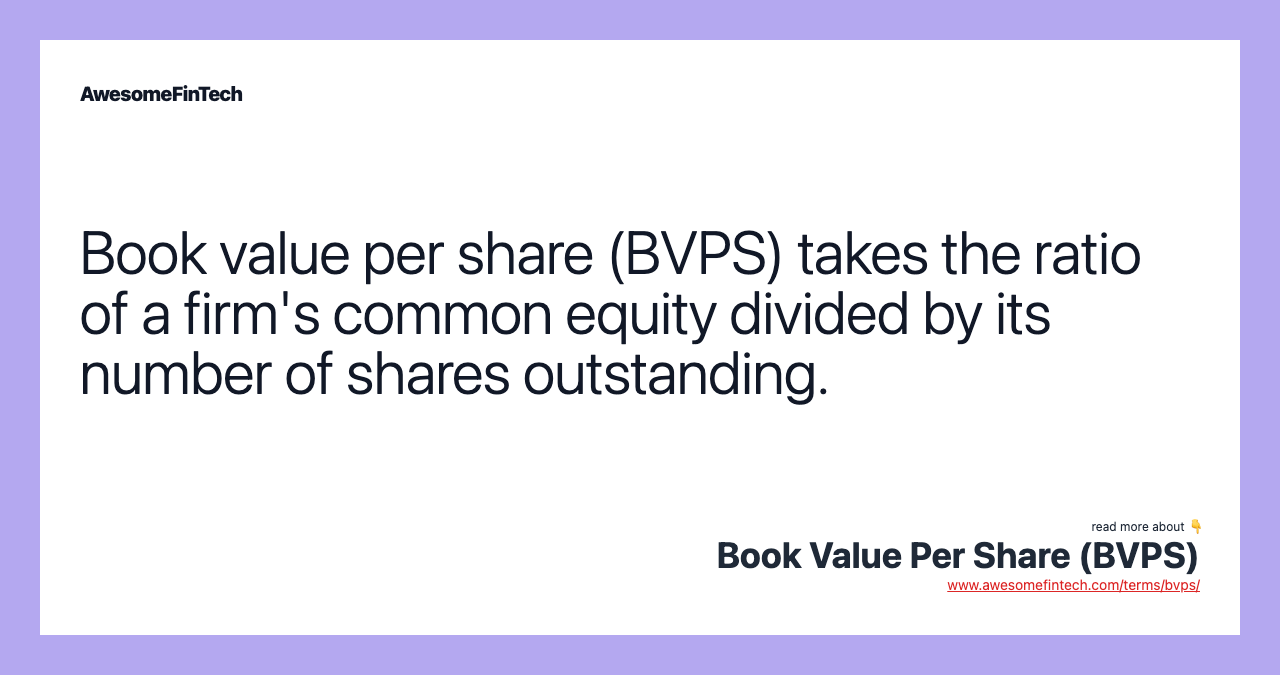

Book Value Per Share BVPS AwesomeFinTech Blog

https://www.awesomefintech.com/term/cards/bvps/card.png

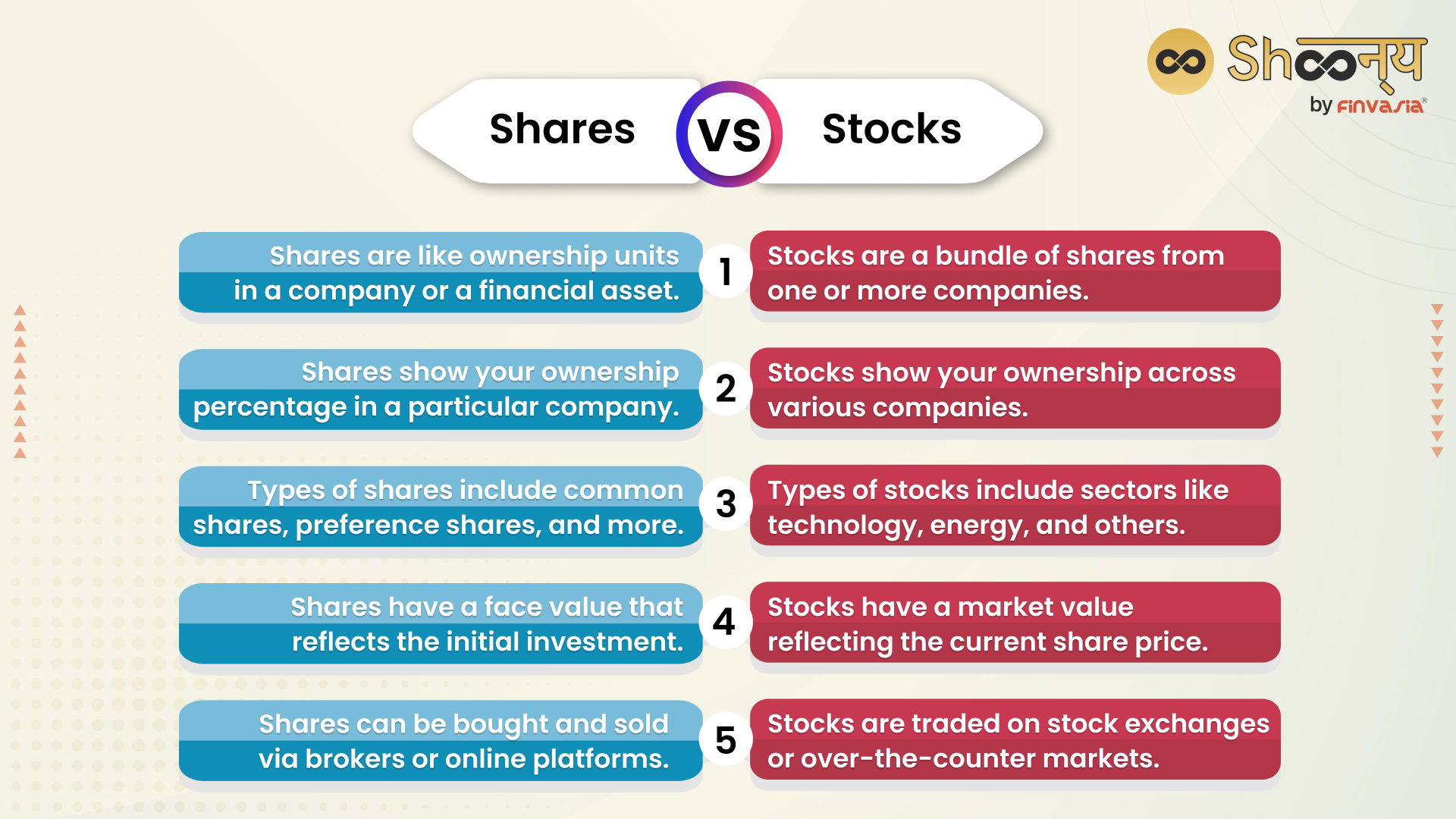

Shares Vs Stocks Understanding The Key Differences

https://blog.shoonya.com/wp-content/uploads/2023/09/14_Sept_Infographic_2.jpg

https://www.financeformulas.net › Book-Value-per-Share.html

The book value per share formula is used to calculate the per share value of a company based on its equity available to common shareholders The term book value is a company s assets

https://streetgains.in › insights › what-is-book-value...

For example if a company has total assets worth 500 crore total liabilities of 200 crore and one crore outstanding shares the book value per share would be

Preference Shares Why Would A Company Issue Preferred Shares Instead

Book Value Per Share BVPS AwesomeFinTech Blog

Accounting For Share Capital Accountancy Knowledge

Difference Between Ordinary Shares And Preference Shares

What Are Shares Outstanding Definition And Meaning Market Business News

Preference Shares And Its Features

Preference Shares And Its Features

Market Value Of Equity Homecare24

Book Value Per Share Formula

Book Value Per Share Formula

The Book Value Of Ordinary Shares Is The Same As - The Book Value per Share BVPS represents the value of a company s net assets per share whereas the market price is the current price at which a stock is trading on the