What Is Book Value Per Share The book value per share BVPS is calculated by taking the ratio of equity available to common stockholders against the number of shares outstanding When compared to the current market value per share the book value per share can provide information on how a company s stock is

Book value per share BVPS is the per share book value Investors can calculate it easily if they have the balance sheet of a company of interest Book Value Per Share BVPS is a crucial financial metric that indicates the per share value of a company s equity available to common shareholders It helps investors determine if a stock is

What Is Book Value Per Share

What Is Book Value Per Share

https://investmentu.com/wp-content/uploads/2022/01/book-value-per-share.jpg

How To Calculate The Book Value Per Share YouTube

https://i.ytimg.com/vi/c2USFect3Zc/maxresdefault.jpg

Book Value Per Share Calculation Best Method YouTube

https://i.ytimg.com/vi/4re5SVtLXeA/maxresdefault.jpg

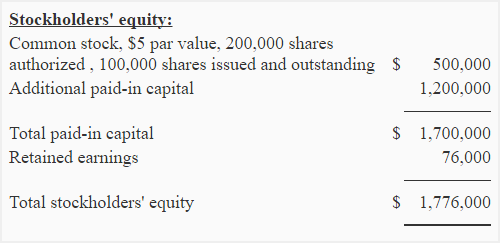

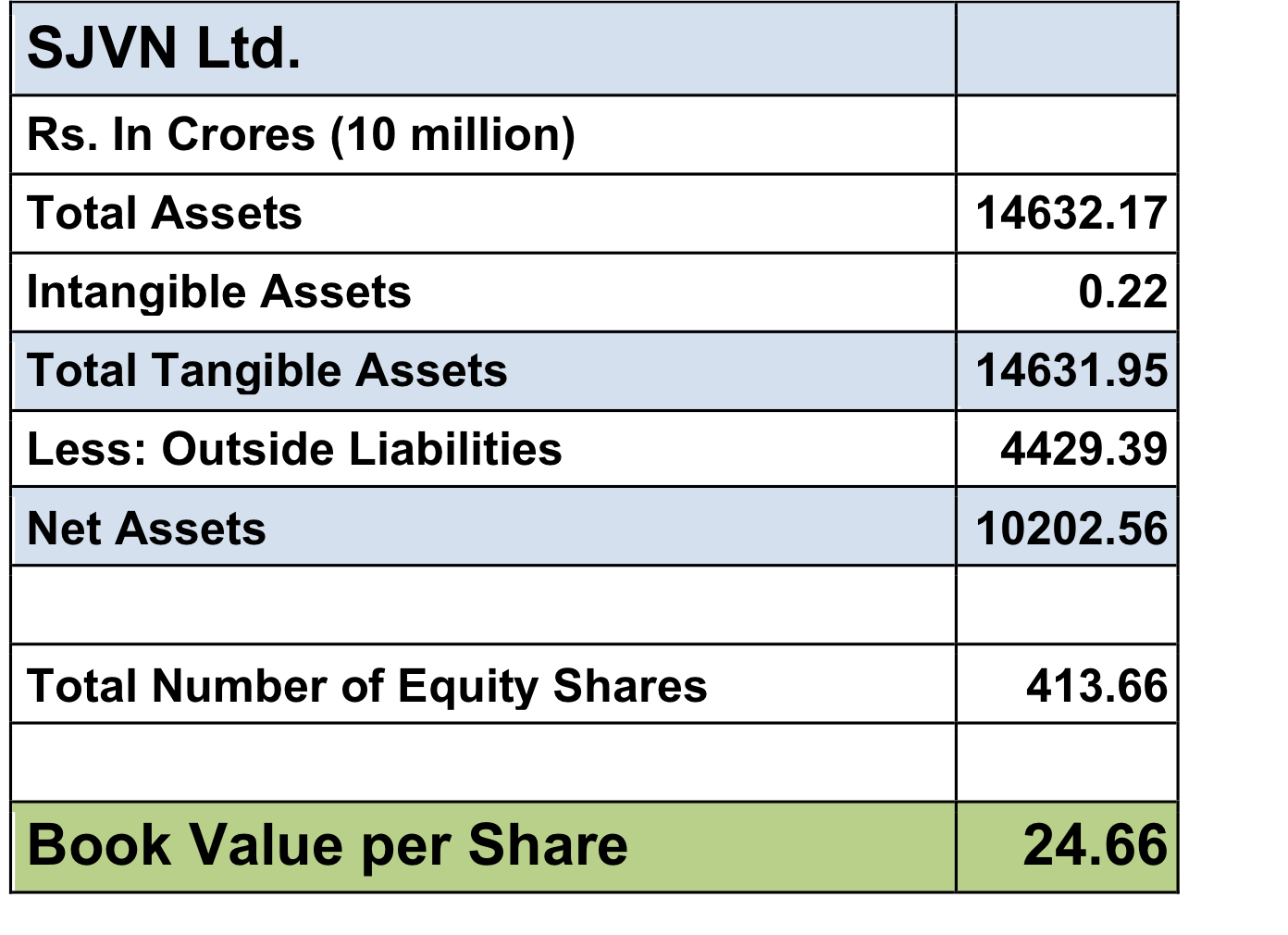

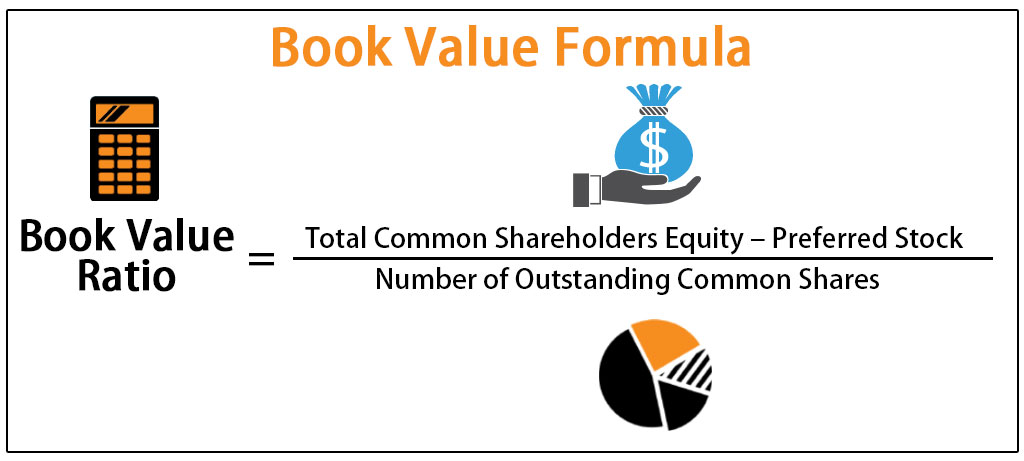

Definition Book value per share BVPS is a ratio used to compare a firm s common shareholder s equity to the number of shares outstanding In the case that the firm dissolves it is the amount the shareholders will receive The formula for determining book value per share or BVPS is BVPS Book Value Number of Shares Outstanding A company that has a book value of 200 million and 25 million

A metric that investors use with regard to book value is BVPS or Book Value of Equity per Share It takes the net value of a listed company s assets also known as shareholder s equity and divides it by the total number of outstanding shares of that organisation The book value per share BVPS is a ratio that weighs stockholders total equity against the number of shares outstanding In other words this measures a company s total assets minus its total liabilities on a per share basis

More picture related to What Is Book Value Per Share

How To Determine The Book Value Per Share YouTube

https://i.ytimg.com/vi/Lg9FQpcIkdI/maxresdefault.jpg

Book Value Per Share Of Common Stock Formula Example Calculation

https://i.ytimg.com/vi/GnsiQ9J6qbk/maxresdefault.jpg

How To Calculate The Book Value Per Share Price To Book P B Ratio

https://i.ytimg.com/vi/5b7RlhdwI5Y/maxresdefault.jpg

Book Value Per Share BVPS is a financial metric that represents a company s book value divided by the number of outstanding shares indicating the value of the company s equity on a per share basis Book Value Per Share BVPS is a crucial metric for investors to understand a company s net value on a per share basis It is an important tool for evaluating the company s market price relative to its book value helping investors make informed decisions

[desc-10] [desc-11]

Book Value Per Share BVPS AwesomeFinTech Blog

https://www.awesomefintech.com/term/cards/bvps/card.png

How To Calculate Book Value 13 Steps with Pictures WikiHow

https://www.wikihow.com/images/2/23/Calculate-Book-Value-Step-12.jpg

https://corporatefinanceinstitute.com › resources › ...

The book value per share BVPS is calculated by taking the ratio of equity available to common stockholders against the number of shares outstanding When compared to the current market value per share the book value per share can provide information on how a company s stock is

https://www.investopedia.com › terms › bookvalue.asp

Book value per share BVPS is the per share book value Investors can calculate it easily if they have the balance sheet of a company of interest

Bac Book Value Per Share

Book Value Per Share BVPS AwesomeFinTech Blog

Book Value Formula How To Calculate Book Value Of A Company

Book Value Per Share Of Common Stock Explanation Formula And Example

Book Value Per Share Formula

Market Value Of Equity Homecare24

Market Value Of Equity Homecare24

Book Value Per Share Formula

:max_bytes(150000):strip_icc()/book-value-99796d4d1fb44bd4bdc961e6042698d7.jpg)

Book Value Per Share Formula

Book Value Formula How To Calculate Book Value Of A Company

What Is Book Value Per Share - Definition Book value per share BVPS is a ratio used to compare a firm s common shareholder s equity to the number of shares outstanding In the case that the firm dissolves it is the amount the shareholders will receive